Nowadays, there are an increasing number of ways by which to process online transactions. Jenni Shuttleworth talks to Ukash, Safecharge and Paypoint.net about what services are available, what makes a good payment service and how the sector is likely to evolve even further.

Payment solutions are integral to any online gaming site and these days, companies and consumers have a range of payment options - from credit cards to alternative payment methods - to choose from. Credit cards are the most popular method for gaming players but there has been a recent rise in the demand for merchants to offer local payment methods.

"Online gaming has been at the vanguard of accepting alternative payments. Few sites only accept credit or debit cards only and most will accept global alternative payment mechanisms such as Neteller and Ukash, plus some localised national alternative payment methods," marketing director of Ukash Paul Coxhill told iNTERGAMINGi.

Currently accepted at gaming sites such as PokerStars, Ladbrokes, PKR and Betsson, Ukash is a solution that enables consumers to turn their cash into a single-use paper or card-based pin code. This code can be used to pay online wherever Ukash is accepted.

Talking about the solution, Coxhill explained: "To consumers, the advantage is that they can use their cash so if they prefer not to reveal their financial information online or simply don’t have a bank card, this is the perfect product. To web merchants, they get access to a new consumer base and have assured payments with no risk of chargebacks."

The service is available from stores in 17 countries across Europe, plus South Africa, Canada, Australia and Uruguay. It can also be obtained from online bank accounts in 22 countries including all of Scandinavia and China, which went live at the end of 2009. Currently, the company’s largest markets are Germany, the UK and Spain. "Much of our expansion has happened in the last year and we are seeing rapid growth in all new markets. We are very excited about the potential of South America and eastern Europe in particular."

Each market has unique characteristics based upon a number of historic factors that range from cultural to infrastructural. "Germany has historically had a low penetration of credit cards and payment services have instead developed on an aggregated debit-based model using services like Giropay. Whereas in South Africa, the rapidly emerging Mzansi society often prefer using their mobiles to pay for services - either through airtime or mobile wallets," said Coxhill.

SafeCharge offers a payment solution that includes payment gateway services with an integrated risk management platform. Its banking relations and local payment methods connect merchants to multiple banks, which allow for maximum uptime as well as more payment opportunities than a payment processor that is connected to only one bank. "We also have features that are tailored to the gaming industry, such as OCT, a program that pays out winnings directly to the player’s credit card for amounts higher than the original deposit, giving the player more loyalty towards that specific site," said Sharon Gal Franko, director of sales and marketing at SafeCharge.

Another feature that the service offers is an affiliate tracking program, which rates and tracks merchant’s affiliates and gives detailed reports about which affiliates contribute to their profits and those that are problematic, bringing chargebacks and declines.

"One major advantage is that when connected to an online payment service," explains Gal Franko, "you are not just connected to them, but to their entire world of banking opportunities. SafeCharge is connected to banking institutions worldwide and as a result, our merchants get to enjoy the benefits. Merchants are integrated into only one system and are therefore relieved of redundant administrative fees and time-consuming application processes."

Another advantage to working with an online payment service is that companies invest their efforts in helping their merchant get the best treatment available from the acquiring banks. In the case of a chargeback or other issues, the payment service represents their merchants to the banks, easing the chargeback process.

Online payment services like SafeCharge are not only connected to global banks, but also local payment methods in various countries. This gives the merchant the ability to market itself in more countries and as its players will feel most comfortable using payment methods that are offered in their language and currency, they will most likely deposit more money to the site.

According to Gal Franko, Europe is showing the most potential for SafeCharge at the moment. Talking about other markets, she told iNTERGAMINGi: "DIRECTebanking is an alternative payment method that is most popular in Germany, Austria, Switzerland and Belgium while iDEAL, another payment method, is popular in the Netherlands."

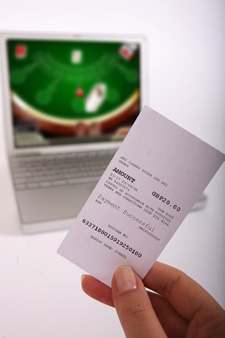

PayPoint.net recently introduced PayCash to its portfolio of services. PayCash is an online payment solution where instead of clicking on the card icon, for example, consumers click on the PayCash icon. This pulls up a receipt onto the screen and after being printed out, is taken to a local pay point where the cash is handed over the counter and the barcode on the receipt is scanned. In real time, that message is passed through to the internet merchant who confirms that the money has been received, which eliminates the risk of fraud, repudiation and chargeback. Michael Norton, MD of PayPoint.net told iNTERGAMINGi: "We collect £9bn a year in cash payments with nine million people coming to 23,000 terminals in the UK, so we know that a great chunk of the UK population prefer to use cash. In the online world it is no different; you’d never assume that you were going to open a high street retail shop and have a sign on the door saying ‘we don’t take cash’. We feel in ecommerce it should be just the same."

PayCash effectively gives people who don’t have credit cards the freedom to spend money online. The service is also aimed at people who avoid using their cards online. "Fifty-six per cent of all transactions are still cash and that’s in the UK where we’re all pretty well banked, so you can imagine what the situation is like in other countries. I was reading some stats on Germany recently where credit card usage is sub 13 per cent," said Norton.

"As a gaming company you should have as many payment solutions as you can possibly get so when somebody comes to your site, payment isn’t a barrier. Whatever they want to do and however they want to pay, their favourite method of paying is there. Allow the consumer to make the choice about which payment method they use. Everyone’s got their own favourite way of paying, their own favourite card. Whatever it is, you shouldn’t try and block anything because you’re just putting a false barrier in the way of someone doing business with you," he continued.

According to Norton, in the gaming industry it takes between US$200 and US$300 through affiliate programmes, advertising and promotion to bring someone to a site for the first time. "If a company has spent all that money on getting a player to its site and they find it interesting and want to open their wallet for the first time, if they can’t do that then the company has basically just thrown away $200-$300 because they’ll go and open their wallet somewhere else. So my view is that the solution has to work how you want it to work."

##image2##

Norton explained that the service should also be easy to use: "If it’s too complicated - if there are lots of hidden fees, if there’s a lot of understanding and registration and sign up and detail involved - it will turn a lot of people away and they won’t wish to register because they’ll think why am I giving all of my details."

Norton continued: "The one thing about credit cards these days is I think there are about 126,000 acquiring banks around the world and you talk to most gaming companies and they’ll tell you that around about 35 per cent of all of their international transactions are declined and about two-thirds of them are declined incorrectly. There isn’t an issue, it’s just that they declined the transaction because they don’t like the idea of it being 3D secure, or they don’t like it being coded as gambling, or because they’ve already made two transactions that week."

SafeCharge’s Gal Franko believes that for a merchant, it is not only the number of transactions coming to the site that is important, but also the quality of these transactions. "A proper risk detection and prevention system can ensure that only valid transactions go through while fraudulent activity is stopped," she explained.

"Operational requirements set by the Payment Card Industry Security Standards Council were established in order to protect card holder data and govern all merchants and organisations that store, process or transmit such data. In order to guarantee that end-user’s credit card details are secure and that the merchant won’t be liable for credit card data theft, any good online payment service should be PCI compliant," said Gal Franko.

"A payment service should develop and implement features that will help their merchants receive the highest approval ratio possible. One such feature is traffic management where transactions are routed to the most suitable acquiring bank based on a number of predefined parameters. Another feature that contributes to a high approval ratio is cascading billing, where if a transaction receives a negative response in the system, it is automatically rerouted to the next best bank and so forth until it has been sent to all banks available for use. That way, there is a much greater chance that the transaction will be approved. Customising treatment and payment services to the merchant’s needs and having company wide customer support will make a good payment service," Gal Franko continued.

Ukash’s Coxhill believes that a good online payment service should be simple to use, comply with relevant regulations and have clear benefits to consumers and merchants that differentiate it from other payment types.

"We are already seeing the massive growth in services that offer micropayments and simple mobile payment options and we expect this growth to continue and for a number of alternative payment methods to become widely accepted as mainstream payment types," he said.

Talking about the future of the online payment sector, PayPoint.net’s Norton said: "I think that there will be more methods of payment that are absolutely right for you. There’s no reason why there shouldn’t be - it doesn’t cost gaming companies more to have more payment methods on their site. I think there are certain companies that just process a transaction and there’s not a lot of value added there, it’s just something that happens. I think moving forward it will be much more about companies that are working with merchants in payments, providing them with more of a bespoke service. What merchants now want is some added value. I think the trend there is working with payment companies that can effectively outsoure a lot of that because it’s so important that you give it to a company who are dedicated to online payments."